Third party financing is a well established financing solution in the united states having emerged in the solar industry as one of the most popular methods of solar financing.

3rd party solar financing.

And 2 power purchase agreement ppa.

Solar leases and power purchase agreements ppas.

For ppas the.

Third party solar financing predominantly occurs in two forms.

If you continue browsing the site you agree to the use of cookies on this website.

Third party financing of solar energy primarily occurs through two models.

Solar industry employment increased by more than 73 000.

Third party financing solar group buy solar garden solar cooperative pace financing green power purchase microgrid cost of solar systems hardware dropped more than 70 in 3 years lawrence berkeley national laboratory the u s.

The pros and cons of third party solar financing for installers with its platform now channeling 2 million per day to credit applications for u s.

Third party solar financing establishing a bankable process slideshare uses cookies to improve functionality and performance and to provide you with relevant advertising.

Such arrangements are especially important for nonprofit institutions like churches and schools that can t otherwise use tax credits to help cover the up front cost of solar.

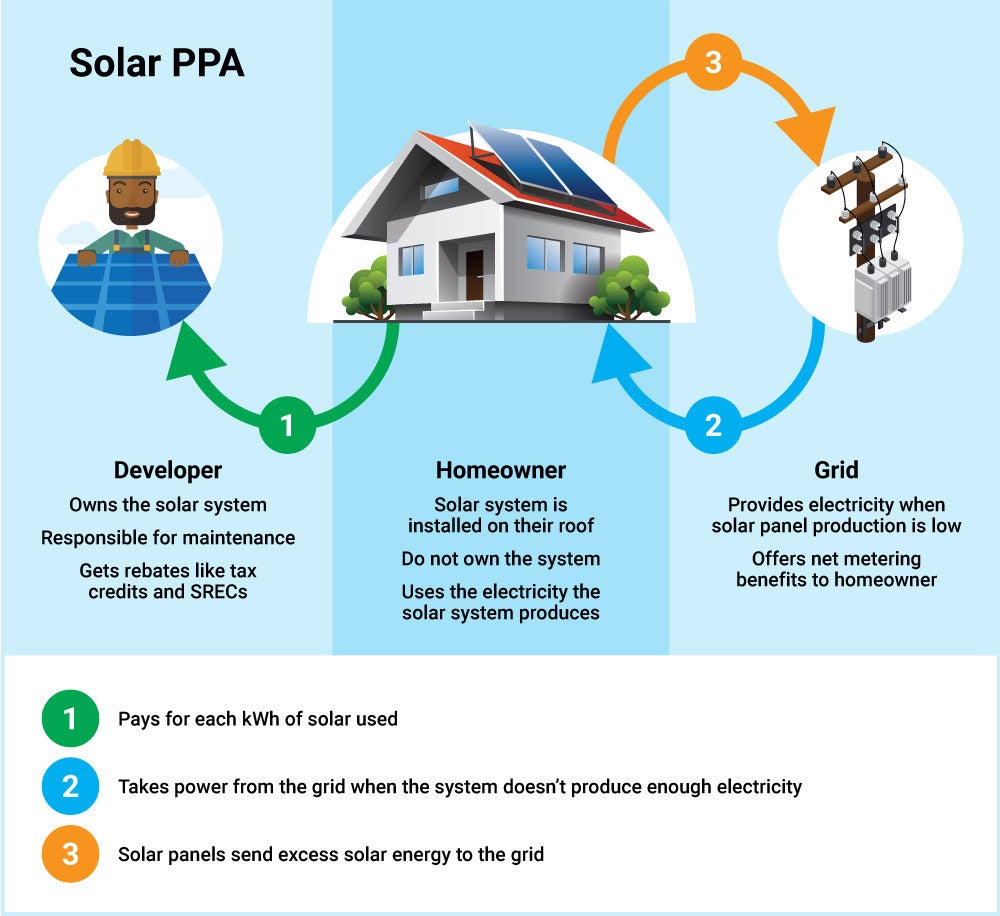

In the ppa model a developer builds a solar energy system on a customer s property at no cost but the system helps offset the electric utility bill.

Under a lease the solar provider installs and owns the system and the customer makes monthly payments to the solar provider.

Third party financing primarily occurs through two models.

Among other allegations the customers allege that solarcity defrauded customers through contracts that contained in many cases provisions related to power purchase agreements.

A power purchase agreement lease agreement is signed between the installer and the consumer at a mutually agreed price tariff.

Added 125 solar panels every minute in 2016 solar energy industries association u s.

Although similar to a ppa under an operating lease the property owner rents the solar energy generating equipment rather than purchasing the actual power produced at a per kwh price.

A structure known as third party ownership however made it possible for willy street to install a new larger solar array a 25 kilowatt installation that went up in spring 2016.

As recently as january of 2016 customers in nevada filed a class action lawsuit against solarcity corporation one of the nation s largest solar leasing companies.

A dangerous precedent solar 3rd party financing 5.

An operating lease is another common third party financing structure.

Under the resco model a third party company finances installs operates and maintains the rooftop solar project.

Pv solar systems clean power finance cpf is.

In the lease model a customer signs a contract with an installer developer and pays for the use of a solar system over a specified period of time rather than paying for the power generated.